JOHN SISK & SON LTD USES SERVICES OF DEINTERNATIONAL IRELAND

DE international assisted John Sisk & Son Ltd. to be compliant with German tax and local regulations during the execution of a recent project in Germany.

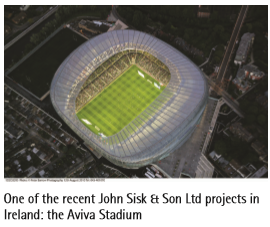

John Sisk & Son Ltd. is the largest general contracting company in Ireland with a turnover in excess of 1 billion. With offices in Dublin, Belfast, Cork, Galway, Limerick, Sligo and Waterford, it has completed major projects throughout Ireland, such as the Aviva Stadium. Besides Ireland and Germany, John Sisk & Son Ltd. is also active in foreign markets like the UK, Poland, Belgium and Abu Dhabi.

To make sure that Joh Sisk & Son Ltd and their contractors were compliant with the German tax law and local regulations while working in Germany, they contracted DE international Ireland in July 2010. After an initial meeting, DE international Ireland advised John Sisk & Son Ltd. about the necessary steps to be taken. These included the registration for tax in Germany and the application for an exemption of German Bauabzugssteuer (equivalent to the Irish Relevant Contract Tax). The German Bauabzugssteuer is 15% in comparison to the Irish 35% Relevant Contract Tax. The application for the German exemption cert of Bauabzugssteuer also requires significant less paperwork and its filing is much easier than the corresponding efforts for the Irish equivalent, the C2 Card.

Besides these tax registrations, the German authorities also had to be notified of the employees which were sent from Ireland to Germany. As the German immigration rules differ from the respective Irish regulations, special attention had to be given to foreign employees, whom are allowed to work in Ireland but are sometimes not automatically allowed to work in Germany.

As some of the employees were supervising construction work in Germany, they also needed their Irish qualification to be recognized by the local Chamber of Crafts in Germany. To obtain this recognition, a certificate from the Irish employment agency FÁS, outlining the qualifications and work experiences, was required.

Construction companies carrying out work in Germany also usually need to register with SOKA-Bau. SOKA-Bau is a holiday fund for workers in the construction industry. This fund was established to make sure that workers posted to Germany receive the same holiday pay as German employees.

When posting employees to Germany and other EU member states from Ireland it is important to apply for the form A1, which is issued by the department of Social and Family Affairs. This form is issued when contributions to the social welfare system are paid for the employees in Ireland. The company must be able to show the certificate when requested by inspectors of German authorities.

John Sisk & Son Ltd. engaged DE international Ireland to register the company for VAT and apply for the Relevant Contract Tax exemption cert. DE international Ireland also provided John Sisk & Son Ltd. with the necessary information to register the employees with the German authorities and to get their qualifications recognized by the local German Chamber of Crafts. Once the company was registered for VAT in Germany, DE international assisted with filling the monthly VAT returns. Additionally, DE international Ireland also supported the subcontractors of Joh Sisk & Son Ltd. to comply with the German regulations while working in Germany.

For more information please contact:

DE international Ireland

Patrick Bamming

AITI Chartered Tax Adviser (CTA)/DiplomKaufmann/TMITI with Irish Tax Institute

Phone: +353-(0)1-6424381

Patrick.bamming@DEinternational.ie